During this time of year our thoughts turn gratefully to our relationships and to all those who have helped enrich our lives personally and helped make our business progress and professional growth possible. To all my family and friends, loved ones, colleagues, connections and contacts, the holidays and new year seem like perfect times for me to say ‘thank you’ and express appreciation to each of you.

There are so many things we can be thankful for and among them I count your friendship and support, as well as your contributions to my growth as a person and professional – in short, our relationship, whether near or far, close or casual, constant or sporadic.

In the year ahead, I look forward to being better at staying in touch with many of you whose time and schedules have not intersected with mine as often as I might like; to facing challenges together and in the process, learning and growing; to listen more to those who mean well, to ignore those who don’t and to try and have the wisdom to know the difference.

Most of all to appreciate the countless blessings around us every day that we far too often take for granted. Thank you!

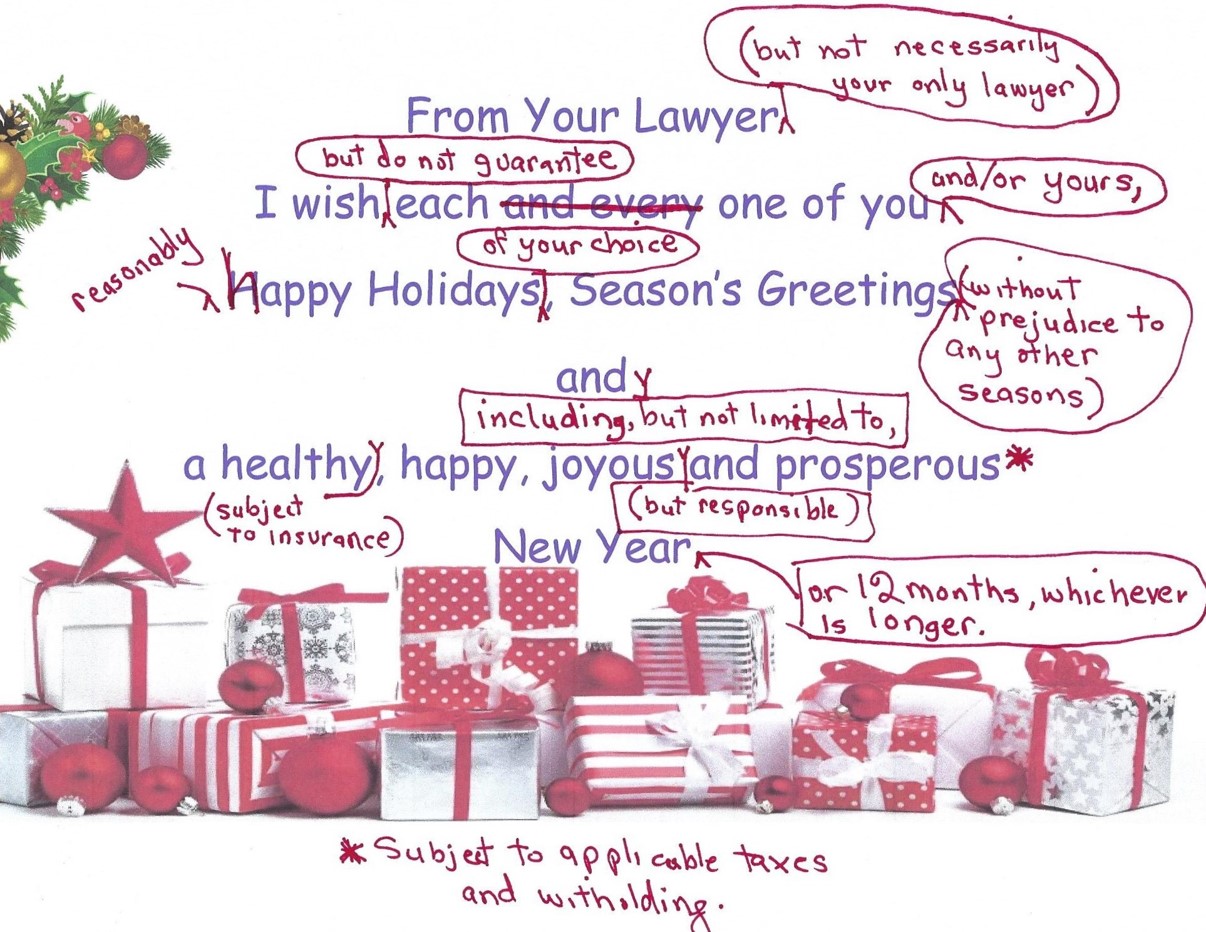

I wish each of you a new year filled with health, happiness and prosperity.

Best wishes,

Joe Rosenbaum